If you run a WooCommerce store, chances are accounting is the last thing you want to deal with. You’re focused on building products, making sales, and growing your business, so bookkeeping often gets pushed aside. Many beginners also assume that since WooCommerce is free, accounting can be figured out later. But delaying proper setup can lead to a tangled mess come tax season.

WooCommerce accounting isn’t about mastering spreadsheets or becoming a finance expert. It is about understanding where your money comes from, where it goes, and how to keep your business financially healthy.

In this guide, we’ll walk you through a beginner-friendly approach to WooCommerce accounting. You will learn how to set things up correctly from day one, integrate with tools like QuickBooks or Xero, avoid common mistakes, and use your financial data to make smarter business decisions.

Let’s dive in. 👇

Table of Contents

What is WooCommerce Accounting & Why It Matters

WooCommerce accounting is the process of tracking all the financial activity that happens in your online store. This includes sales, refunds, inventory costs, shipping charges, payment processing fees, taxes collected, and overall profits.

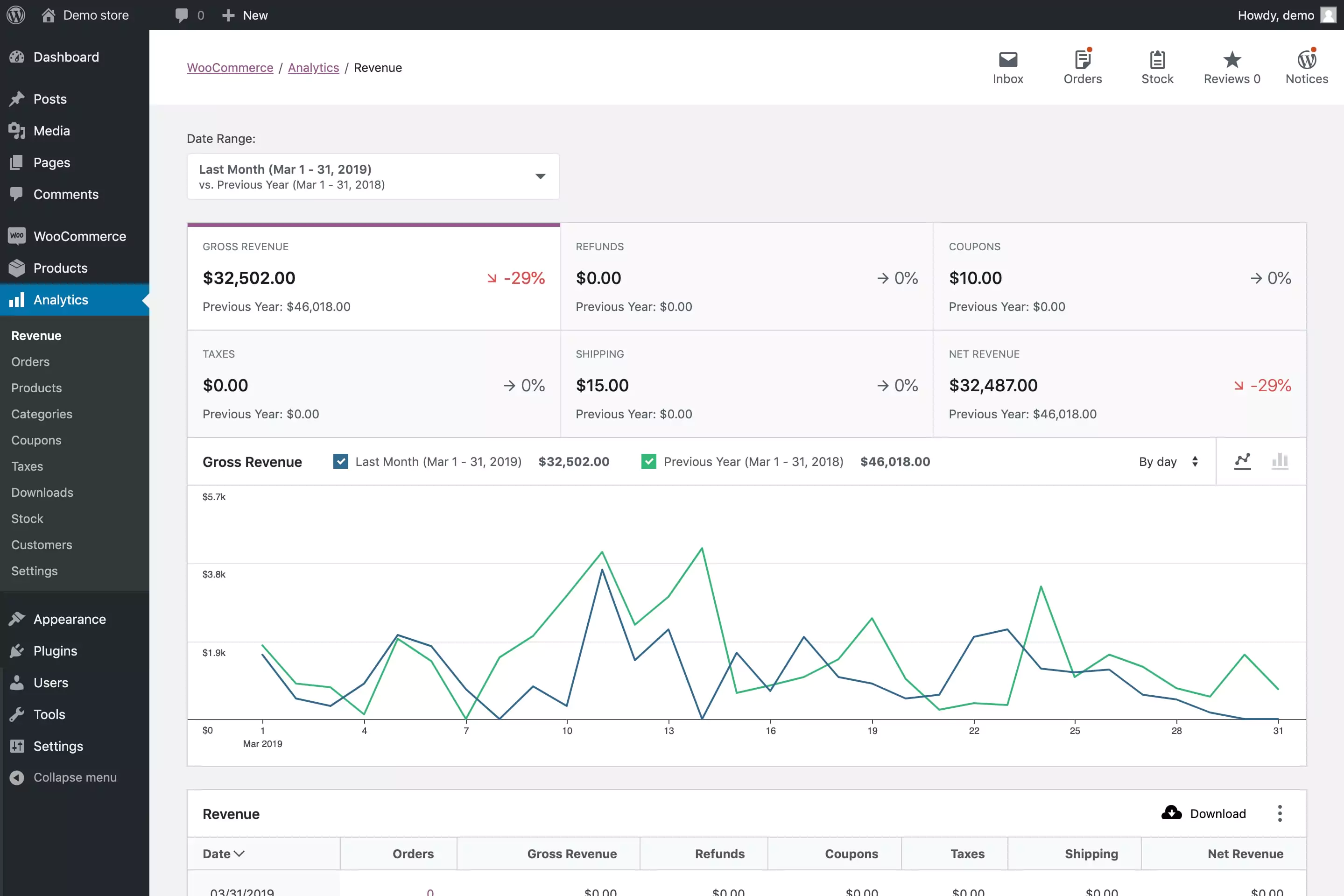

While WooCommerce does show basic sales figures in your dashboard, that is just one part of the financial picture.

Good accounting gives you clarity on how your store is really performing. It tells you whether you are making money or just generating revenue. It also helps you plan for expenses, keep your taxes in order, and understand what you can afford to invest in next.

Some of the key benefits of proper WooCommerce accounting include:

- Tax compliance: Avoid late fees, penalties, and unnecessary stress by keeping accurate tax records.

- Profit clarity: Know the difference between revenue and actual take-home income, so you can make better decisions.

- Cash flow visibility: Track what money is coming in and going out each month.

- Smarter planning: Use real financial data to decide when to invest in new inventory, launch a marketing campaign, or expand your offerings.

- Loan readiness: Have reliable reports in place in case you ever apply for funding or a business loan.

Without proper accounting, it becomes difficult to manage cash flow, set the right prices, or scale your business confidently. You may even face tax penalties or miss out on funding opportunities because your financial records are incomplete.

WooCommerce accounting has its own challenges, too. Payment delays, refund tracking, tax compliance, and integration with other platforms all make it slightly more complex than traditional retail. But with the right setup, you can handle all of it with ease.

Essential WooCommerce Accounting Setup Steps

If you are just getting started, the idea of setting up a complete accounting system for your WooCommerce store may feel overwhelming. But once you break it down into simple steps, it becomes much more manageable. Below is a beginner-friendly guide that will help you lay the right foundation from the start.

Step 1: Separate your business and personal finances

Mixing personal and business expenses is one of the most common (and costly) beginner mistakes.

The first thing you should do is open a dedicated business bank account and use it solely for store-related income and purchases. Whenever you need to buy something for your WooCommerce store, whether it’s web hosting, a plugin, or inventory, use a business debit or credit card. Avoid using personal accounts, even temporarily. Keeping these transactions separate will make bookkeeping much simpler and will save you hours of sorting during tax season.

Step 2: Choose your accounting method

There are two basic approaches to tracking income and expenses: the cash method and the accrual method.

With the cash method, you record a transaction only when money changes hands. With the accrual method, you record transactions as they happen, regardless of when the payment is actually received or made.

For example, if a customer places an order in June but pays in July, cash accounting would log it in July, while accrual accounting would record it in June.

Most WooCommerce stores benefit from the accrual method because it provides a clearer view of seasonal performance, inventory costs, and long-term growth. That said, smaller stores or businesses just starting out may prefer the simplicity of the cash method. If you’re unsure which to use, consult an accountant before committing.

Step 3: Set up a proper chart of accounts

A chart of accounts is like the filing system for your store’s money. It organizes all the different types of income, expenses, and assets so you can track them properly.

At a minimum, your chart should include:

- Income categories such as product sales, shipping income, and taxes collected.

- Expense categories like advertising, payment gateway fees, web hosting, and inventory.

- Asset accounts, if you want to track things like unsold inventory or equipment.

Most accounting tools like QuickBooks or Xero provide a default chart of accounts, but you can (and should) customize it to fit your store’s needs.

Step 4: Configure WooCommerce for accurate data

Before you start integrating with accounting software, make sure WooCommerce is set up correctly to collect and report financial data.

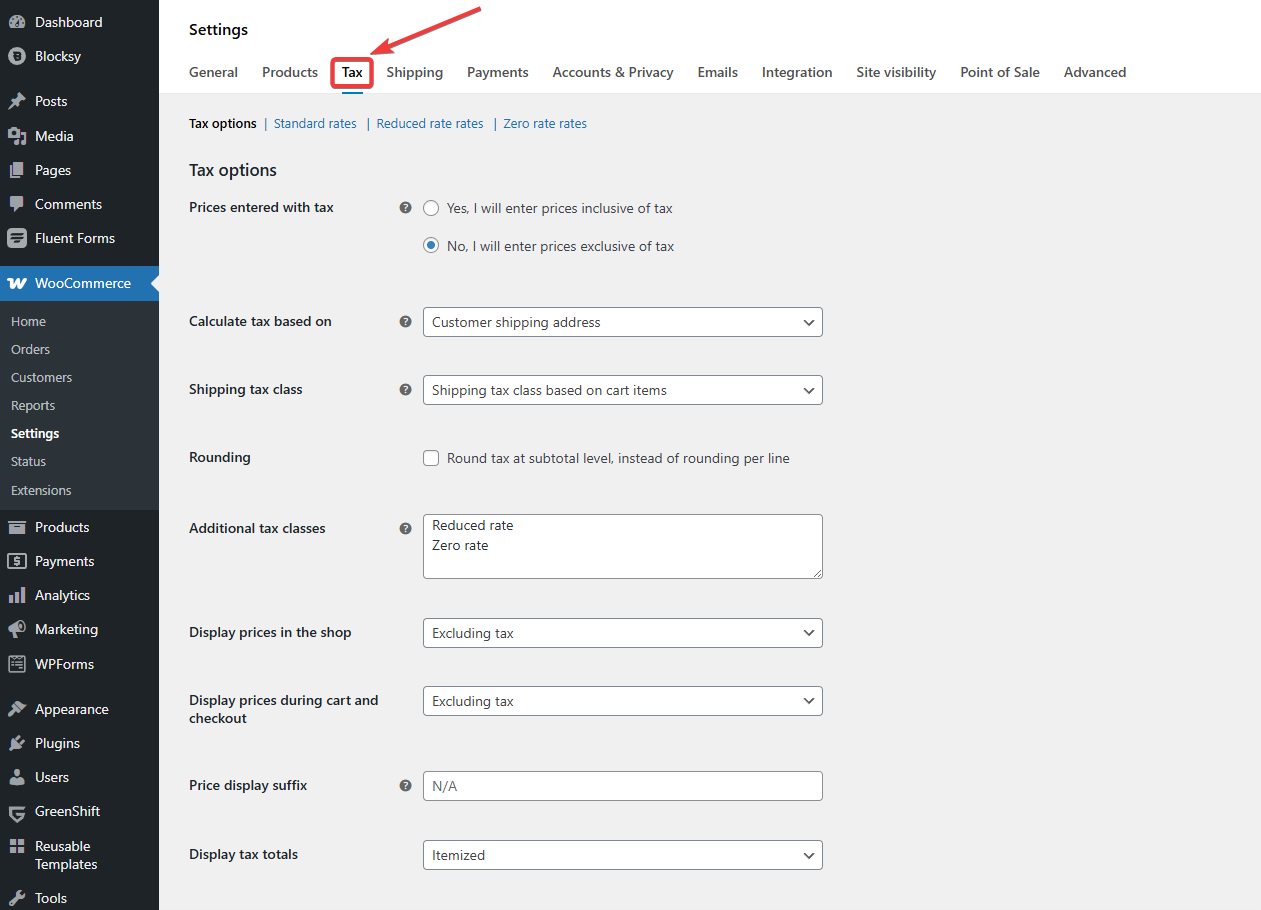

Enable tax settings under WooCommerce → Settings → Tax, and set appropriate tax rates for your store’s location and customer base.

Check your payment gateway reports to ensure payments, refunds, and fees are being logged accurately. Turn on inventory tracking if you sell physical products. This helps calculate your cost of goods sold and track margins.

Use a reliable, WooCommerce-optimized theme like Blocksy that doesn’t interfere with checkout or order data collection. A good theme ensures your store runs smoothly and your reports stay accurate.

Step 5: Establish record-keeping habits

Once your store is up and running, the key to accurate accounting is consistency. Get into the habit of saving every receipt, invoice, and payment record, whether digital or physical. The sooner you record expenses, the more likely you are to remember what they were for.

Set aside time each week or at least once a month to review your books, categorize transactions, and run basic reports. If your store is starting to turn a profit, it’s also a good idea to prepare for quarterly tax payments rather than waiting until the end of the year. These habits don’t take long to build, but can make a big difference in reducing financial stress later on.

Popular WooCommerce Accounting Software Integrations

Connecting your store to the right accounting software can save hours of manual work. These tools sync your sales, expenses, and inventory automatically, making it easier to stay organized and tax-ready.

QuickBooks

QuickBooks is a comprehensive accounting solution that helps WooCommerce store owners manage invoicing, payments, expenses, payroll, and reporting from a single dashboard. You can connect your bank accounts for automatic transaction syncing, set up recurring invoices, and get real-time cash flow insights. Its automated reconciliation tools reduce manual work, while built-in anomaly detection can flag potential issues early. QuickBooks also integrates with popular payment gateways, supports multi-currency transactions, and connects with hundreds of business apps. For businesses that need extra support, QuickBooks offers access to live bookkeepers and tax professionals.

Pricing starts at $19/month for the Simple Start plan, with tiers like Essentials ($37.50/month) and Plus ($57.50/month) adding more users and features, and the Advanced plan is $137.50/month for larger teams.

Xero

Xero is a cloud-based accounting platform built for small and medium-sized businesses that want flexibility and automation. It offers online invoicing with automated reminders, bank reconciliation, inventory tracking, and expense management, all accessible from any device. Xero integrates with over 21,000 global banks for seamless bank feeds and supports a wide ecosystem of third-party apps. You can track projects, create purchase orders, manage payroll for small teams, and handle multi-currency transactions with ease. The dashboard gives a clear, real-time snapshot of your finances, while reporting tools make it easy to monitor performance and share updates with your accountant.

Pricing starts at $29/month for the Starter plan, $46/month for Standard, and $69/month for Premium, with optional add-ons like expense tracking for $4/month and project tracking for $7/month.

FreshBooks

FreshBooks is designed for freelancers and service-based businesses that need simple yet powerful accounting. It makes invoicing fast and professional with customizable templates, recurring billing, and automatic payment reminders. You can track time for client projects, manage expenses with built-in receipt scanning, and accept payments through credit cards, ACH, and PayPal. FreshBooks also offers detailed financial reports, including profit and loss statements and tax summaries, and it integrates with a wide range of business apps. Collaboration is straightforward, allowing clients or team members to view relevant project and payment information.

Pricing starts at $2.10/month for the Lite plan (up to five clients), $3.80/month for Plus (up to 50 clients), and $6.50/month for Premium (unlimited clients). Custom pricing is available through the Select plan for businesses with more complex needs.

Choosing the Right Integration

Not every WooCommerce store has the same accounting needs, so the “best” integration depends on your business model, transaction volume, and workflow preferences. Start by identifying your must-have features.

If you need advanced inventory management, look for software that tracks stock levels and cost of goods sold automatically. If you work with clients or projects, time tracking and invoicing features may be more important.

Consider how each tool integrates with WooCommerce. Some require a dedicated plugin, while others connect via third-party services like Zapier. Direct integrations tend to be more reliable and offer real-time syncing, while indirect ones may have delays or limited data mapping.

Also, think about scalability. A tool that works for your current needs should also be able to handle higher sales volumes, multiple currencies, or added sales channels in the future. Finally, factor in cost, not just subscription fees, but also any paid add-ons you might need as your business grows.

Managing WooCommerce Taxes & Compliance

Tax rules can be one of the trickiest parts of running a WooCommerce store. Depending on where your business is based and where your customers are located, you may need to collect different tax rates for different regions. To avoid surprises, make sure you enable and configure tax settings in WooCommerce → Settings → Tax before launching your store.

You can set rates based on product types, shipping, and location. If you sell across multiple states or countries, consider using a plugin like TaxJar or Avalara. These tools automatically calculate the correct rates, update tax tables, and generate reports.

Keeping detailed records of taxes collected and filed is essential. Export tax reports regularly, store receipts and invoices securely, and track deductible business expenses like hosting, themes, and advertising. If your store becomes profitable, plan for estimated quarterly tax payments to stay ahead.

Key Reports & Metrics to Track

Once your store is set up and integrated with accounting software, make it a habit to review a few essential financial reports each month:

- Profit & Loss (P&L): Shows how much money your store is actually making after expenses.

- Cash Flow Statement: Helps track how money is moving in and out of your business.

- Balance Sheet: Gives a snapshot of your store’s assets, liabilities, and equity.

- Sales Tax Reports: Ensure compliance and make tax filing easier.

Beyond reports, keep an eye on key eCommerce metrics like gross profit margin, customer acquisition cost, average order value, and inventory turnover. Most accounting tools let you automate report generation, so you can stay informed without spending hours on spreadsheets.

Conclusion

Accounting may not be the most exciting part of running a WooCommerce store, but it is one of the most important. Starting with the basics, such as a separate business bank account, a clear accounting method, and reliable software, can save you from future headaches. The earlier you put these systems in place, the easier it becomes to stay organized, compliant, and financially confident.

You don’t need to master every tax rule or become a bookkeeping expert overnight. Instead, focus on building good habits and choosing tools that simplify the process. Plugins and services that sync with WooCommerce automate most of the heavy lifting.

Also, do not underestimate the impact of small decisions. Choosing an optimized theme like Blocksy helps your store run smoothly and avoids technical issues during checkout or reporting.

With the right foundation, you can spend less time on spreadsheets and more time growing your business.